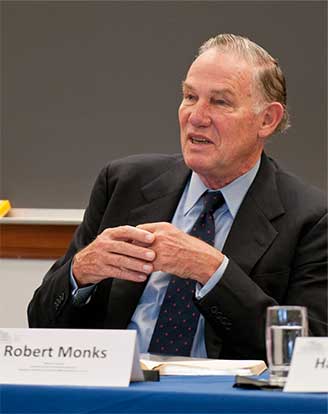

The Emperor’s Nightmare

From angry shareholders to concerned chief executives, almost everyone knows at a gut level that the present political system is not working. This book finds the root cause to be poor corporate governance. In the prequel to this book, The Emperor’s Nightingale, Robert A. G. Monks, one of the world’s foremost shareholder activists, had warned corporations against putting short-term profit ahead of long-term value for all stakeholders. Few listened – and the result was system-wide trauma that only bold solutions can heal. In The Emperor’s Nightmare, his latest book, Monks reveals what can happen when corporate leadership abandons the common good to court and conquer a powerful elite. This insightful, honest, and direct portrayal of corporate governance and the surrounding political system will be of immense value to those interested in corporate governance – particularly shareholder and stakeholder advocates, and the true corporate leaders who serve them. In the end, better corporate governance means better democracy. This book shows the way.

Citizens DisUnited

(Miniver Press, 2013). Citizens DisUnited: Passive Investors, Drone

CEOs and the Corporate Capture of the American Dream is an indictment of corporate executives divert

shareholder assets to undermine democracy and enrich themselves, putting both capitalism and democracy

at risk. Featuring a new report on the behavior and characteristics of indexed companies. Once again,

Monks lays bare the problems of governance and government – problems…

Corporate Governance – 5th Edition

by Robert AG Monks and Nell Minow. (Wiley 2011)

The new edition of this successful text offers an indispensable guide to the key concepts of corporate governance every student and business professional should know. It includes more exercises and student questions, penetrating analysis of the latest examples of corporate failure and controversy, and the lively “cases in point” which have characterized previous editions.

- Features 16 case studies of corporations in crisis, including General Motors, American Express, Time Warner, IBM, and Premier Oil

- Contains an invaluable web link to The Corporate Library, the leading independent research firm dedicated to corporate governance

- Includes an Appendix with an overview of CG Guidelines and Codes of Best Practice in Emerging Markets

Corporate Valuation for Portfolio Investment

(Wiley, 2010) Written with Alexandra Lajoux.

“A detailed guide to the discipline of corporate valuation. Designed for the professional investor who is building an investment portfolio that includes equity, Corporate Valuation for Portfolio Investment takes you through a range of approaches, including those primarily based on assets, earnings, cash flow, and securities prices, as well as hybrid techniques. Along the way, it discusses the importance of qualitative measures such as governance, which go well beyond generally accepted accounting principles and international financial reporting standards, and addresses a variety of special situations in the life cycle of businesses, including initial public offerings and bankruptcies. Engaging and informative, Corporate Valuation for Portfolio Investment also contains formulas, checklists, and models that the authors, or other experts, have found useful in making equity investments.”

Corpocracy

(Wiley, 2007).

“Shareholder control over large corporations is worryingly weak and the unrestrained hunt for profits is taking a toll on the environment and society. In Corpocracy, corporate lawyer, venture capitalist, and shareholder activist Robert Monks reveals how corporations abuse their power and what we the people must do to rein them in. In a clear and careful analysis, Monks outlines a plan for reconciling the competing interests of corporations and society through thoughtful shareholder activism.”

Reel and Rout: A Novel

(Brook Street Press)

“A novel of corporate intrigue by the world’s foremost shareholder advocate.” “Reel and Rout is a timely novel that exposes the backroom and boardroom shenanigans that plague corporations and that have led to a daily dose of headlines and scandals. From Enron to Global Crossing to ImClone we are inundated with the suspicion that all is not right with the business world. Filled with colorful New York lawyers, inept trustees, avaricious bankers, and even a few devoted public servants who care about more than the latest sex scandal, Reel and Rout is a tale of greed gone wild but in a world where some try to accomplish good.”

Corporate Governance – 3rd Edition

(Blackwell) Co-authored by Robert A.G. Monks and Nell Minow.

In the wake of the dramatic series of corporate meltdowns: Enron; Tyco; Adelphia; WorldCom; the timely new edition of this successful text provides students and business professionals with a welcome update of the key issues facing managers, boards of directors, investors, and shareholders. In addition to its authoritative overview of the history, the myth and the reality of corporate governance, this new edition has been updated to include: analysis of the latest cases of corporate disaster; An overview of corporate governance guidelines and codes of practice in developing and emerging markets new cases: Adelphia; Arthur Andersen; Tyco Laboratories; Worldcom; Gerstner’s pay packet at IBM. Once again in the new edition of their textbook, Robert A. G. Monks and Nell Minow show clearly the role of corporate governance in making sure the right questions are asked and the necessary checks and balances in place to protect the long-term, sustainable value of the enterprise.

The New Global Investors

(Capstone Publishing Limited, 2001)

The New Global Investors explains that pension funds have a fiduciary responsibility to provide retirement security for plan participants, and plan trustees are legally responsible to invest in their beneficiaries’ best interest. Plan sponsors therefore have a duty to demand that managements of the companies in their portfolios are not only working effectively to maximize profits today, but also acting in a socially and environmentally responsible manner to ensure sustainable value for the future.

The Emperor’s Nightingale

(Capstone Publishing & Addison-Wesley Publishing, 1998)

Included here are links to both publishers, the Forward, written by Dean LeBaron, and brief executive summaries of each chapter. The Emperor’s Nightingale takes a much broader view of the relationship between the owners, managers and directors of the corporation and draws heavily on the insights of the latest thinking on economic and general complexity theory.

Watching The Watchers: Corporate Governance for the 21st Century

written with Nell Minow (Blackwell Publishers, 1996).

A comprehensive look at the implications of the corporate governance movement for the future of large public corporations – and the world in which they exist. Third in a series of crucial texts on corporate governance by acknowledged leaders in the field, Robert A.G. Monks and Nell Minow.

Corporate Governance

(Blackwell, 1995)

This is the first comprehensive textbook to focus on corporate governance — one of the most important development in business over the last decade. The abuses and excesses of the takeover era and the exponential growth of the institutional investor have transformed the roles of the shareholders, managers and directors of publicly held companies. Corporate Governance explains how it happened, where it is going, and what the impact will be. Including extensive case studies and selected outside materials, this is an indispensable resource for students of business, law and public policy. Co-authored by Bob Monks and Nell Minow. First Edition is available.

Power And Accountability

(Harper Business, 1991)

Bobco-authored Power and Accountability with Nell Minow, his long-time collaborator in the field of corporate governance and current business partner in the active investment firm LENS. Power and Accountability remains required reading for anyone interested in the development and basic tenets of modern corporate governance theory.